Kenya’s 2025/26 Budget Policy Statement: Key Highlights and Implications

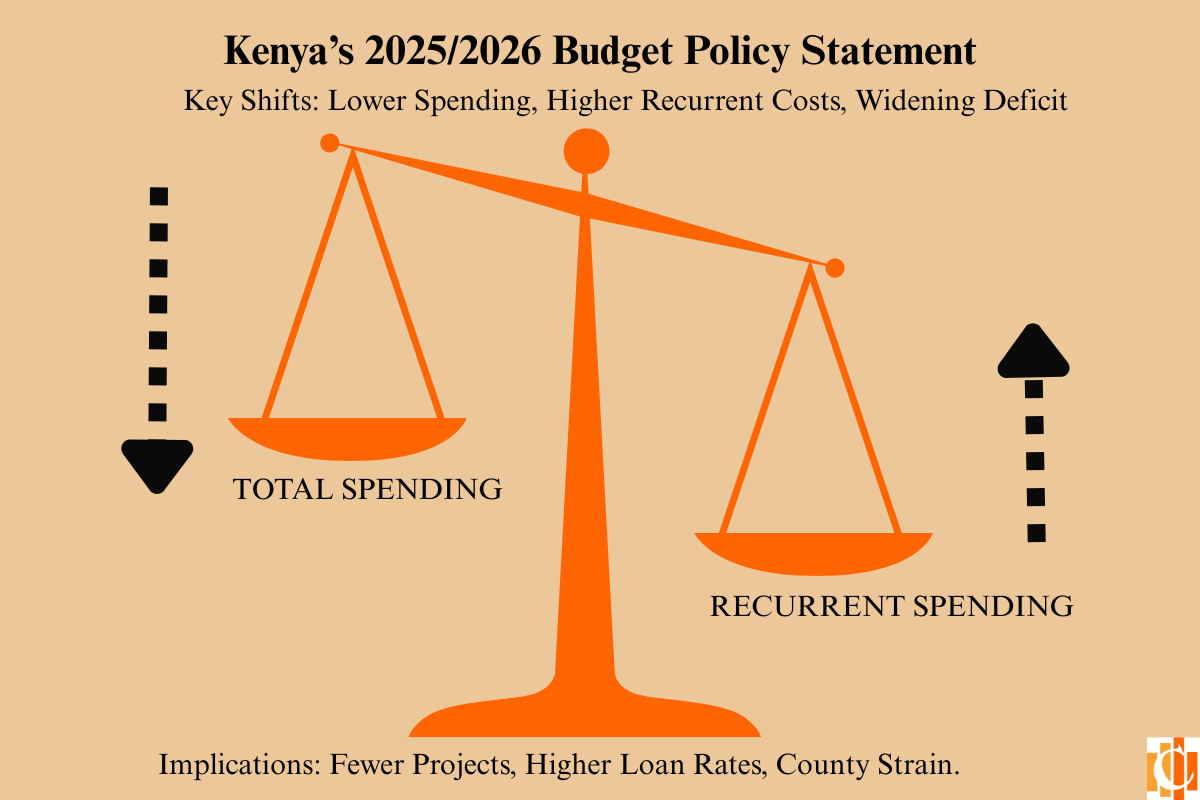

Kenya’s 2025/26 Budget Policy Statement has been tabled in the National Assembly, revealing notable shifts in the country’s fiscal planning. While total government expenditure is set to reduce, some key areas—particularly recurrent spending—are receiving increased allocations.

Below is a breakdown of the major adjustments and what they mean for the economy.

1. Lower Spending, Higher Recurrent Costs

• Total expenditure was cut by KES 66.2B to KES 4.263T.

• Recurrent spending up by KES 19.4B to KES 3.096T.

• Development budget down by KES 79.6B to KES 725.1B.

2. Revenue Challenges and Widening Deficit

• Revenue target cut by KES 130.8B to KES 3.386T.

• Ordinary revenue down KES 183.8B, while Appropriation-in-Aid up KES 52.9B.

• Deficit widens by KES 71.6B to KES 831.0B.

3. Shift in Borrowing Strategy

• Domestic borrowing target up by KES 138.4B to KES 684.2B.

• External borrowing decreased by KES 66.9B to KES 146.8B.

• More local borrowing could keep interest rates high.

• County allocations reduced by KES 6.0B to KES 436.7B.

• This could strain essential services at the county level.

• Fewer infrastructure projects due to lower development spending.

• Higher domestic borrowing may keep loan rates high.

• Counties may struggle with reduced funding.

• Revenue shortfalls could lead to future tax hikes.

The government faces a tough balancing act—tightening spending while meeting growing obligations. The final budget will be key in shaping Kenya’s economic outlook.

Chartafai – Audit Firm in Kenya

By Njeru Mwangi

Managing Partner