Harnessing Artificial Intelligence (AI) in Tax Optimization

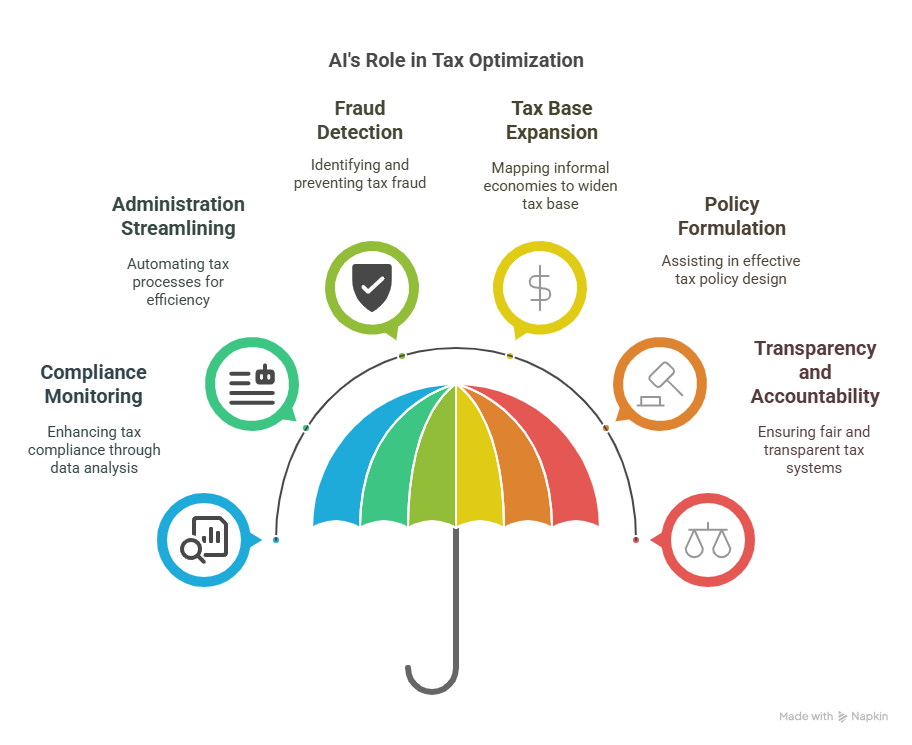

The arrival of Artificial Intelligence (AI) brings revolutionary opportunities for future tax optimization processes because of continual business changes. AI’s capability to inspect extensive data alongside its predictive functionality and process automation allows tax authorities together with businesses to enhance compliance and minimize inefficiencies and maximize tax administration efficiency.

The capabilities of AI systems become evident while detecting tax-related fraud activities and fighting against them. VAT fraud poses one of the major challenges among all tax fraud schemes. AI systems make diagnoses of normal patterns from transaction data to detect duplicate invoices as well as abnormal trading behaviors. The discovery of fraudulent activities before they spread becomes possible for tax authorities through their operations which safeguard system security along with preventing tax loss.

The tax authorities expand their tax base through AI systems which help identify new taxable entities. Economic monitoring powered by artificial intelligence allows detection of fresh revenue streams in the informal sector which reaches vast proportions of economies. AI technology enables organizations to monitor satellite images together with mobile money data alongside other information sources for establishing market sizes of informal markets. The tax authority leverages gathered data to develop proper formalization procedures to include informal businesses into their tax system.

The tax consulting optimization process gets revolutionized by AI because it utilizes policy creation together with extensive impact analysis. AI systems analyze previous data through computational models to determine multiple targeted situations that assist policymakers in developing tax protocols that are effective and unbiased. Using predictions from AI analytics helps decision-makers make data-driven choices because AI systems provide forecasts about revenue performance besides enforcement data and economic development percentages.

Business organizations achieve better flexibility through AI systems during periods of accelerated business environment transformations. Better systems and perpetual strategies must come from tax authorities due to the digital world’s effect on e-commerce and remote work which alters traditional business operations. AI prediction functionalities help tax authorities identify upcoming challenges which enables them to modify their operational guidelines. AI enables tax officials to perform real-time digital cross-border operation monitoring which gives them awareness about emerging industry trends and enables them to obtain tax revenue from new industrial sectors.

AI implementation in tax optimization helps establish clear standards of financial transparency within operations. The real-time capability of AI analytics together with automated processes decreases both corruption and human error occurrences. Taxpayers choose to comply voluntarily with tax authorities because the system operates fairly and impartially therefore they maintain trust in the system.

Chartafai – Audit Firm in Kenya

By Njeru Mwangi

Managing Partner