Navigating Compliance in Kenya – What Businesses Need to Know

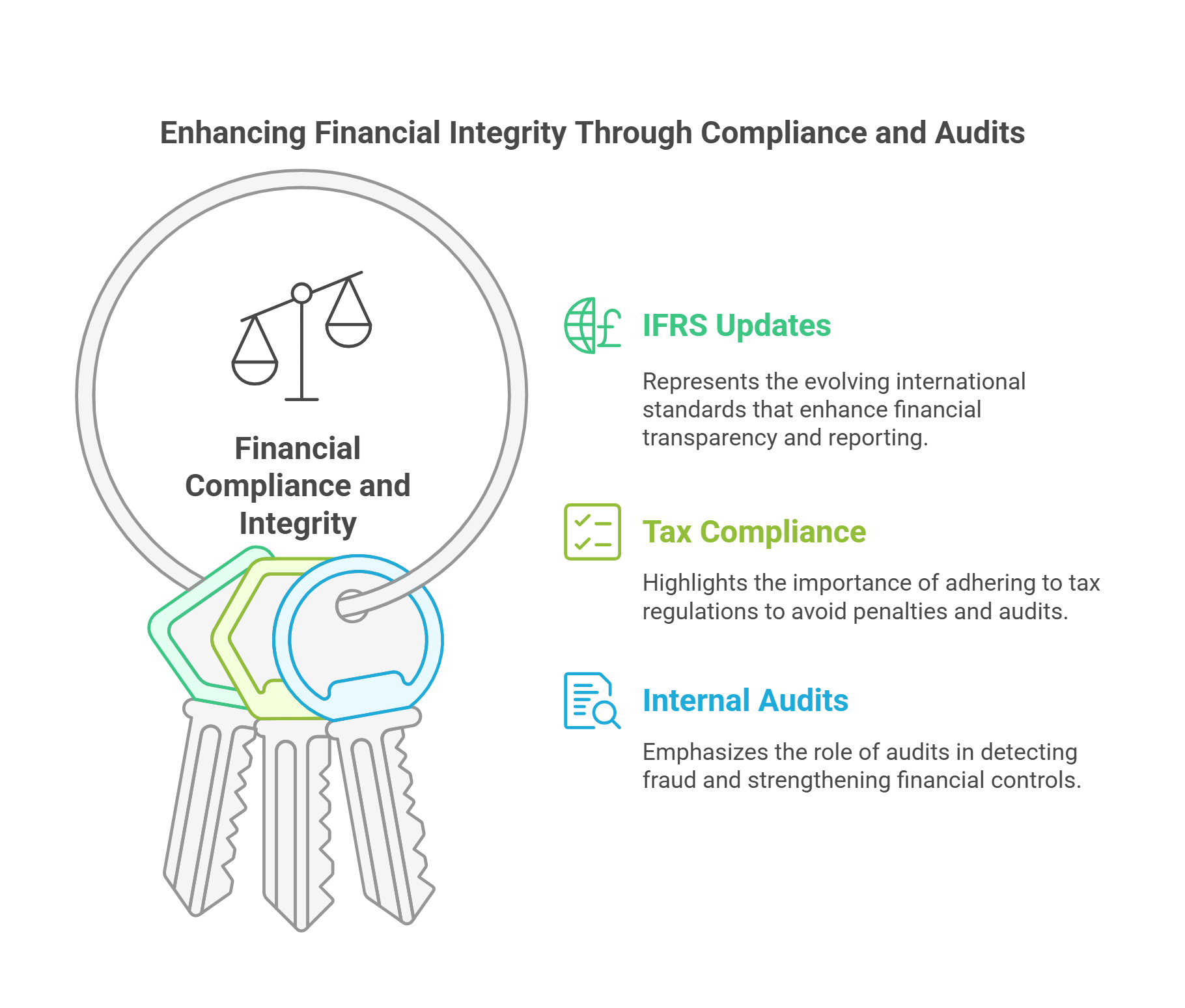

Maintaining compliance in Kenya’s changing regulatory environment is crucial for the stability and expansion of businesses, in addition to being required by law.

Businesses need to keep ahead of the curve in order to prevent expensive fines and harm to their reputation due to changes in tax regulations, financial reporting standards, and fraud concerns.

What you should know is as follows;

1. Effects of IFRS Changes on Businesses

Financial reporting is impacted by the ongoing evolution of the International Financial Reporting standards(IFRS) compliance, tax planning, and reporting. Important updates consist of:

- By unifying the measurement and recognition of insurance contracts, IFRS 17(Insurance Contracts) mandates that insurers increase the transparency of financial statements.

- Clearer disclosures, such as how companies categorize obligations as current or non-current, are now emphasized in IAS 1 (Presentation of Financial Statements)(Presentation of Financial Statements)

- New guidance on deferred taxation of assets and liabilities from transactions such as leases and decommisioning expenses is introduced by IAS 12 (Income Taxes)

Tip: Companies should evaluate the effects of these modifications on their tax planning and financial statements.

2. Common Tax Compliance Mistakes & How to Avoid Them

The Kenya Revenue Authority (KRA) is scrutinizing Kenyan companies more and more when it comes to taxes.

Common compliance pitfalls include:

- Late VAT & PAYE filings, leading to heavy penalties.

- Incorrect tax deductions, resulting in audits and fines.

- Non-compliance with eTIMS, as real-time tax reporting is now mandatory.

- Withholding Tax (WHT) errors, where businesses fail to remit the correct amounts on payments for professional services, interest, and dividends.

Solution: Ensure automated tax tracking, regular compliance reviews, and a clear understanding of sector-specific WHT obligations to avoid disputes with KRA.

3. Your First Line of Protection Against Fraud: Internal Audits

Internal audits are an essential tool for maintaining financial integrity because fraud risks are rising. An effective internal auditing system is beneficial

- Early detection of financial irregularities and misstatements is key.

- Prevent fraud and bolster internal controls.

- Gain the confidence of stakeholders, investors and regulators.

Tip: Consistent internal audits improve openness and guarantee adherence to financial reporting guidelines and tax regulations.

Important Compliance Topics for Companies

Businesses should concentrate on the following areas to ensure compliance:

- Finance compliance – Make sure taxes are accurate, avoid fraud, and adhere to IFRS/GAAP.

- Regulatory Compliance – Comply with industry regulations, hold onto your licenses, and keep yourself informed.

- Employement and labor law – Manage contracts, maintain workplace equity, and abide by wage laws.

- Cybersecurity & Data Protection: Secure data, train staff, and adhere to GDPR/CCPA.

- ESG Compliance: Adhere to ethical norms, comply with environmental regulations, and coordinate CSR.

- Anti-Corruption & Ethics: Train employees, promote whistleblowers, and abide by anti-bribery legislation.

- Industry-Specific Compliance: OSHA for manufacturing, HIPAA for healthcare, and AML/KYC for finance.

- Contractual & Supplier Compliance: Keep an eye on suppliers, control risks, and review contracts.

- Risk management includes conducting audits, keeping an eye on compliance, and being crisis-ready.

By Njeru Mwangi

Managing Partner